A study by Mastercard revealed that 79% of global respondents use contactless payments, and 82% of them view it as the cleaner way to pay.

What the above numbers simply say is this - consumers worldwide were already moving towards contactless payments and shopping, but the COVID-19 pandemic sped up this transition.

Many consumers switched their primary payment card to one that supports contactless technology. Another study conducted by Visa in India reported a 6x growth in contactless payments for face-to-face transactions.

The rise in contactless payments means technologies like scan, pay, and go also became more prominent as more and more retailers started implementing them. This is not only because of the safety and hygiene concerns that arose during the pandemic but also due to its convenience, security, and ease of use.

Now, security is one of the most crucial aspects for both consumers and businesses when it comes to payments. It is essential for retailers like yourself to establish trust with customers by guaranteeing a secure shopping experience and payments.

Once you understand the operation and level of security provided by scan, pay, and go systems, you can confidently engage with your customers to guarantee their peace of mind.

This blog is for retailers like you who wish to gain insight into the security and advantages of scan, pay, and go solutions. Let's explore and understand why this approach is actually more secure than you might realize, and how you can take advantage of it.

First, let’s start by understanding the scan, pay, and go technology.

What is scan, pay, and go technology?

In simple terms, scan, pay, and go is a method that lets your customers complete their shopping by scanning QR codes of the products they want to buy and then making a payment via their mobile wallet or other means.

These systems prioritize simplicity and speed while also guaranteeing the security of transactions. The beauty of scan, pay, and go systems is in their user-friendly interface and compatibility with various payment systems.

How it works

Scan, pay, and go solutions work just like how the name implies. Your customers scan barcodes (or QR codes) on the products they want to buy and proceed with their shopping. Once they are finished shopping then they can instantly checkout and pay straight from their smartphone. When the transaction is completed, you and your customers get notified. Your customers then proceed to exit the store after a quick verification of the digital receipt for their shopping.

Compatibility

A significant benefit of scan, pay, and go is its extensive compatibility. It doesn’t matter what your customers prefer - mobile wallets like Apple Pay, Google Pay, PayPal or NFC cards, or any other NFC-enabled devices, these systems are compatible with all options.

This gives your customers the freedom to select their preferred payment method. Moreover, the flexibility of these systems allows retailers like you to accommodate a wider variety of customers, which makes the shopping experience more inclusive.

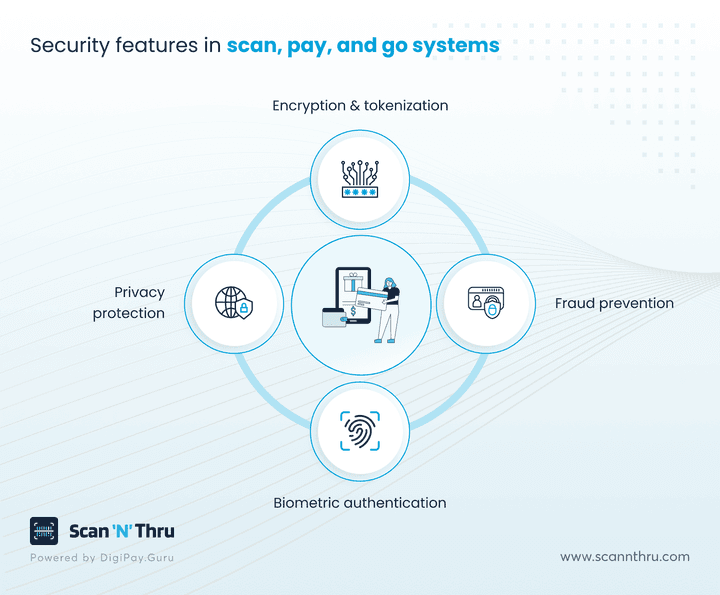

Security in scan, pay, and go systems

Having looked at the simplicity and convenience of scan, pay, and go technology, let's now discuss what’s even more essential—security. Your customers may initially be attracted by convenience, but it is security that ensures their peace of mind and convinces them to shop with you again and again.

Scan, pay, and go systems offer various security measures that guarantee safer payments and transactions. Let’s see them one by one:

Encryption and tokenization

All scan, pay, and go transactions are securely encrypted to safeguard sensitive information. This basically means that any financial or payment details are converted into secret codes so that they just appear as some random data.

Besides, tokenization substitutes real payment details with randomly created tokens. This means even if fraudsters manage to access this data, it is useless to them.

These security measures make sure that your customers’ financial information remains confidential throughout the payment process.

Minimizing fraud

Preventing fraud is among the top priorities for any payment system. Scan, pay, and go systems tackle this through the use of advanced security measures like encrypted codes, 2-factor authentication, and more that safeguard both customers and retailers. As the payment information doesn't go through your system, it significantly reduces the risk of any data breaches or hacking attempts.

Protecting personal information

Data privacy is also a genuine concern for your customers, and you can’t take that lightly. Scan, pay, and go apps; make sure to protect all personal information.

When your customers are confident that their information remains safe as no sensitive data is exchanged during the payment procedure, they can shop without worrying. This is incredibly helpful for retailers like you because it builds trust and ultimately boosts your brand loyalty.

Biometric Authentication

Scan, pay, and go solutions are usually equipped with mobile wallets. These wallets are powered by biometric authentication like fingerprint scanning or facial recognition as an additional security layer.

With such measures in place, even if someone gets a hold of a customer's phone, they still can't make a payment without biometric confirmation.

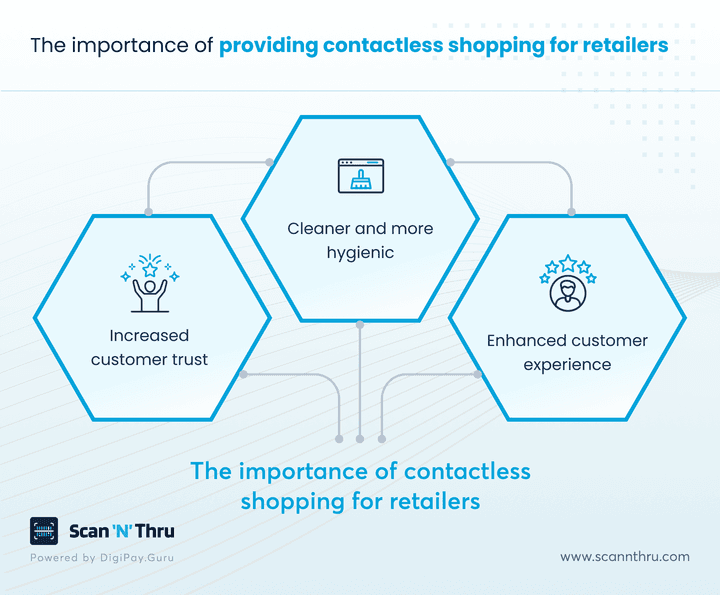

Why retailers should prioritize contactless shopping

Modern consumers demand all—speed, convenience, and security. Hence, for retailers like you, this means adopting a system that offers all of that.

Let’s see how scan, pay, and go solutions can help you achieve that:

Building consumer trust

Security is essential for establishing trust with your customers. They are more inclined to make repeat purchases from you if they trust the security of their transactions.

Scan, pay, and go apps as we have seen, offer robust security measures like encryption and tokenization that protect sensitive financial data. Having such a system in place sends a message to your customers that you care about their security and privacy.

Cleaner and more hygienic

Even though the pandemic ended, many hygiene-centric consumers still prefer contactless payments because of health & safety reasons. This is why retailers like you should offer your customers that option, otherwise you’re losing a chunk of business.

Scan, pay, and go apps enable you to provide your customers with contactless shopping and payments. With these apps, your customers can pay with their smartphones directly instead of cash. This eliminates the need for physical contact with the cash counter or your staff member during the payment process.

Enhanced customer experience

A seamless and secure self checkout process can make a huge difference in the customer experience. With scan, pay, and go, your customers don’t have to worry about their card information being stolen, nor do they have to handle physical cash or worry about the availability of card readers.

This smooth and hassle-free experience leaves a positive impression on them, which encourages loyalty.

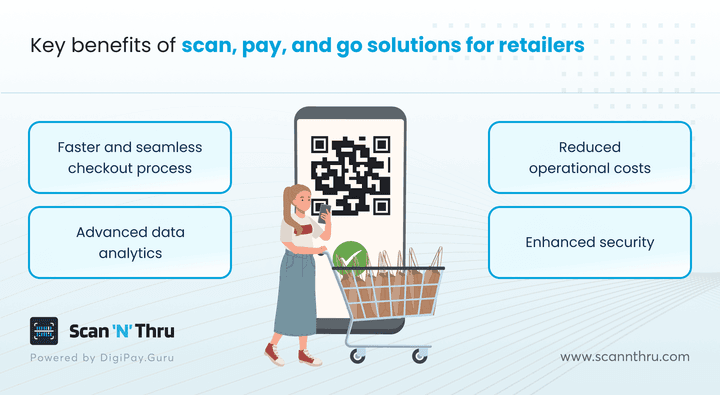

Key benefits of the scan, pay, and go technology for retailers

Seamless and quick checkout

For retailers, one of the biggest benefits of scan, pay, and go technology is the speed at which transactions can be completed. Customers can quickly scan barcodes (or QR codes) to add products to their cart and pay directly from the app itself. This eliminates the need for long lines at checkout counters. The efficiency of the system enhances customer satisfaction, especially in busy retail environments.

Reduced operational costs

In addition to creating a smoother shopping experience, scan, pay, and go technology can help reduce operational costs. Retailers can lower expenses associated with traditional payment terminals and processing fees, as scan, pay, and go systems often have lower transaction fees. This cost-effectiveness allows retailers to allocate resources more efficiently.

Read more: How Scan 'N' Thru solutions are redefining the shopping experience at retail stores?

Valuable data insights

Beyond just being a secure payment method, scan, pay, and go technology provides valuable data insights. You can gather data about your customers’ preferences, popular products, and buying trends. This data can then be used to refine marketing strategies, adjust inventory, and make data-driven decisions that increase your sales and profits.

Enhanced security

Compared to traditional systems like credit cards or cash, self-checkout offers an enhanced level of security. As described earlier - with encryption, tokenization, and biometric authentication, the chances of a data breach or fraudulent activity are significantly reduced. This provides a much safer option for you and your customers.

Future-proofing your business

Finally, adopting scan, pay, and go technology helps businesses like yours stay competitive. As more businesses adopt digital payment methods, having a secure, advanced system in place allows you to keep up with the latest trends in payment technology. With this, you can ensure you aren’t left behind as the industry evolves.

Conclusion

You’re now aware of how scan, pay, and go technology is more secure than the traditional checkout methods. Its ability to protect sensitive information, while also offering a fast and seamless checkout experience, makes it an essential tool for retailers like you. But beyond convenience, it’s the security that truly sets this technology apart.

Building customer trust largely depends on providing a payment system that prioritizes security. With features like encryption, tokenization, and biometric authentication, contactless checkouts ensure that your customers' personal and financial data are kept safe.

As modern customers are more vigilant and value their privacy now more than ever, it’s the responsibility of retailers like you to meet the demands of such customers.

If a question arises where you’d get a scan, pay, and go solution that offers the kind of security discussed in the article, then look no further than Scan ‘N’ Thru.

It has all the security features like encryption, tokenization, biometric authentication, and more. Plus you are getting a solution that can integrate with your existing systems and you can customize it as per your requirements.

If you're a retailer looking to offer secure, contactless shopping, now is the time to explore Scan ‘N’ Thru solution and give your customers the peace of mind they deserve.